The mobile revolution within the banking sector is one of the hottest topics in today's tech-oriented climate. Along with related areas such as cryptocurrency, personal finance, and investing, the way we use banking services is increasingly relying on mobile devices but also on the availability of quality mobile banking services.

Not long ago, banking was an area operated almost exclusively by the banks themselves. Now several new players have joined the game with an abundance of mobile banking and mobile wallets available for every platform.

The reason is apparent—people want a quicker, safer, and tailored experience when operating with their money.

Mobile Banking is on the Rise

Photo by /CC0

Photo by /CC0

The advent of smart devices, which happened a little over a decade ago, brought convenience to users, simultaneously ushering in the beginning of the end for some industries. Print media, travel, recreation, and brick-and-mortar retail took a big hit due to customers moving from physical to digital. The same is expected to happen with banking, and stats show that one of the global pillar industries is already moving towards "mobile over physical."

Statistics place the number of US mobile banking users between 57 mln (Statista) and 115.6 mln (eMarketer). The 2018 Mobile Banking Study by Citi Bank found out "that 91 percent of mobile banking users prefer using their app over going to a physical branch." These stats and many more are telltale signs that the traditional baking model is undergoing a significant reevaluation; and one that doesn't come without its challenges.

Convenience: More Than a Luxury

Photo by Johannes Plenio/CC0

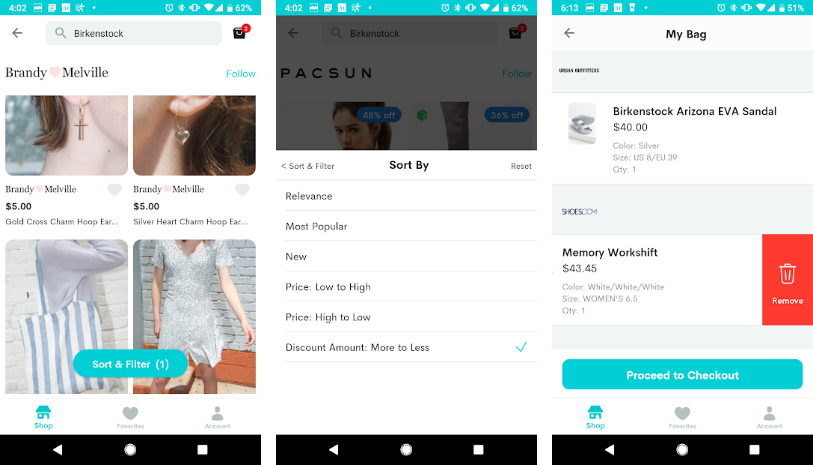

Of course, the main advantage of mobile banking is more convenience when compared to the traditional "branch-visit" model. From shopping and receiving paychecks, through settling utility bills, with mobile banking apps, you can do virtually anything money-related, in just a few taps.

While such uses are apparent to most people, mobile banking software is finding good use in a thriving industry—playing at online casinos—which serves as a good use case for the use of mobile money management software.

Be it as an entertainment, a side hustle or a primary source of income, playing casino games online is now available for mobile, letting players manage their gaming and bankroll from the same device. The growth of mobile banking and online gaming has prompted some online casino operators to accept a variety of eWallets in addition to the more traditional deposit methods. Here are some of the main benefits that eWallets have brought to online casino players, though they extend to any payment situation:

- Like when using a credit card, deposits become "live" instantly.

- Some eWallet provide their patrons with digital banking cards which can be activated and deactivated by the user for an added security.

- Users can also set limits over their eWallets which benefits responsible gambling.

- The best such apps use tokenization payment which means that during a transaction the client's sensitive information (like the card number) is encrypted and replaced with a "token".

- Another great benefit of eWallets is that they let users securely store the details for all of their bank cards and accounts in a single place. Thanks to that users can deposit money or withdraw their winnings with just a few clicks.

Speaking of deposits, the American Bankers Association did a survey last year which found out that 59% of mobile baking users use their device to deposit a check at least once monthly; 37% do so twice or more in a month. Furthermore, sometimes convenience is not a luxury but a necessity; for example, in remote areas where few businesses, let alone banks, set up shop.

Bloomberg reports on a Ghanian entrepreneur who is part of the vast network of Africa's mobile-banking agents who facilitate banking services for people living in areas that don't have ATMs or bank branches.

Safe or Not?

Photo by Pixabay/CC0

Just like convenience is the main advantage of mobile banking, it is precisely this concentration of access and information that poses the most significant challenge.

As a user of a mobile banking or mobile wallet app, you could connect your utilities, credit cards, and even investment accounts and service them all from the same place. This means not only skipping several branch visits but also not even having to visit different online platforms. This also means that pretty much all of your personal information is stored in one place.

Unfortunately, while cybersecurity has come a long way, so have hackers' attacks. A host of corporations, governments, and high-profile individuals were victims of hacks and data leaks, which, naturally, makes some people wary of relying too much on technology when it comes to private information.

An article published by a Forbes contributor, and titled "The Good, The Bad, & The Ugly Of US Mobile Banking Experiences In 2019" concludes that in general, the US mobile banking experience is "awful at […] reassuring users on security and privacy."

Nevertheless, experts involved in the banking services comparison platform Bankrate, say that in reality, mobile banking is safer than perceived. Yet one cannot be too careful.

Conclusion

Photo by Pixabay/CC0

The benefits of mobile banking are unquestionable.

Instead of having to go to a bank, you carry the bank in your pocket 24/7. You can send and receive money in an instant, which could literally be a life-saver, and with some apps, you even get help with the tedious task of filing your taxes.

By the looks of it, advancements in the area will continue with at full throttle, serving a wider variety of users, and further instilling mobile banking as the first choice among customers. But will mobile manage to overtake traditional banking or will the two continue to co-exist?

from Phandroid https://ift.tt/2MGhN07

via

IFTTT

Photo by /CC0

Photo by /CC0